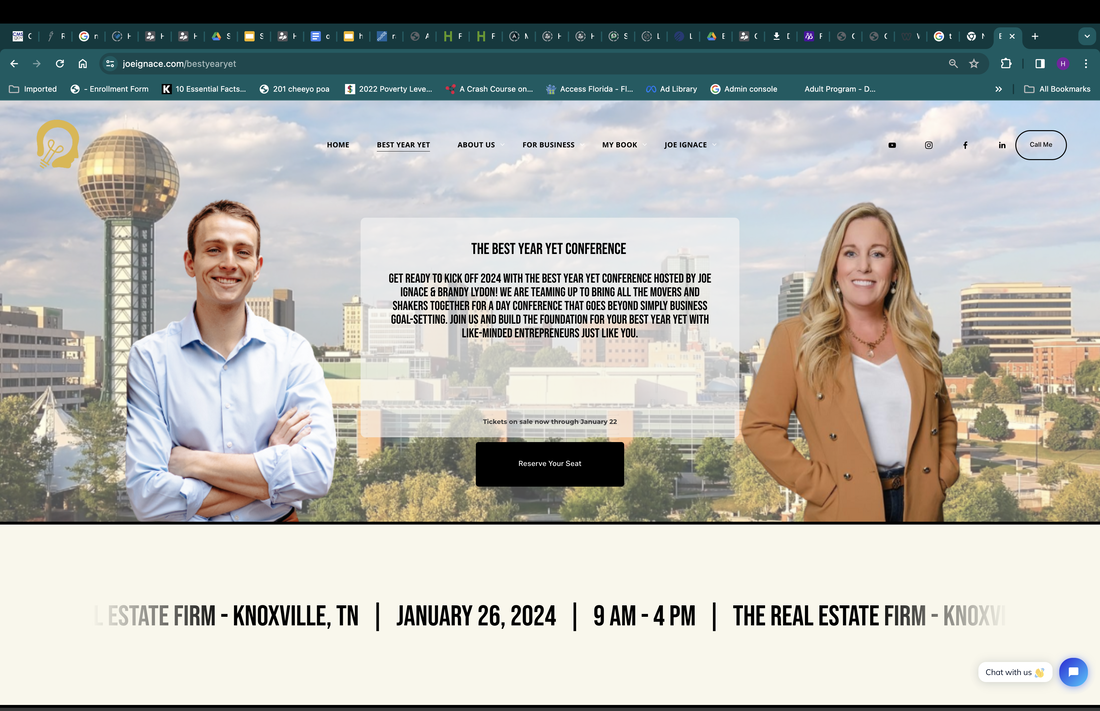

BEST YEAR YET

In 2024, Medicare improves to give you greater access to health treatments.

These are some of the changes you may encounter next year, one of the most important is that the %5 coinsurance for Part D catastrophic coverage will be eliminated, there will also be a new limit of $8,000 on Part costs D among other benefits. Good news! The inflation reduction law is causing drug costs to drop and LIS 2024 (LIS Low Income Subsidy Program) increases its coverage for 300,000 people as well as eliminating the partial LIS program and expanding the full LIS program. Another benefit is $0 for Part D premiums and deductibles if they are between 135% and 150% of the federal poverty limit. During 2024 you will not pay a deductible for hospital coverage during the first 20 days of each benefit period, and an increase in the base Medicare PART B premium will also be projected. In 2024, Part B premiums are projected to increase approximately $10/month compared to 2023. The Deductible Phase will be eliminated. Now, your Part D plan will pay for your medications right away; your “orange phase” in the chart costs you $0. Catastrophic Coverage will also be eliminated in 2024 and you will no longer pay 5% of the cost of medications. For next year there will be a $9.80 increase in the standard monthly premium for Medicare Part B enrollees. By 2024, the standard premium for immunosuppressive medications will be $103.00. The Medicare Part A inpatient hospital deductible that beneficiaries pay if they are admitted to the hospital will increase by $32 from 2023. In 2024, beneficiaries must pay a coinsurance amount slightly higher than in 2023 during the hospital stay and for lifetime reserve days. Beneficiaries in skilled nursing facilities will also see a slight increase in daily coinsurance for extended care services in a benefit period. The hospital deductible for inpatients will increase by $32 in 2024 and the daily hospital coinsurance between days 61 and 90 will increase by $8, likewise the daily hospital coinsurance between days 61 and 90 will increase by $16 and a daily skilled nursing facility Coinsurance between days 21 and 100 will increase by $4. Why Dental Care and Dental Insurance is ImportantThe history of dentistry dates back to the 1630s, but it wasn't until the 1840s that dental school was introduced. Therefore, for 210 years, the person you were referred to as your barber was also your dentist. As a result of their lack of training and inadequate equipment, they caused more harm than good. The only treatment provided at the beginning of dentistry was extraction of the tooth, which was then followed by infection. The dentists did not realize that there could be a lot more done than just pulling out teeth. There has been an evolution not only in dental care but also in dentists themselves. Dentists all over are changing peoples lives.

In 2022, we currently have six main different specialties of dentistry; orthodontist, endodontist, oral surgeon, pedodontist, periodontist. After two years of working in the dental field, serving active duty soldiers, I have realized that many people are unable to receive dental care due to high dental insurance costs or the fact that they were not taught how to brush and floss their teeth as children. This can result in trauma for the person, and after they become adults, they have little interest in maintaining their oral health. Consequently, people develop periodontal disease and cavities, which are the two most prevalent dental diseases. In the case of front teeth that are visible when smiling, these diseases can eventually lead to extractions. In this case, the missing tooth will have to be replaced with an implant so an artificial tooth can be used in its place. Depending on the complexity of the process, it can cost up to $3,000 per person. Dental work can be extremely expensive, as shown in that example, as expensive as it is it really can be life changing to have a brand new smile. We at Citizens Solutions Insurance want you to have the best dental plan possible and we want you to have your life changing smile, so in the event of something like that we will have you covered. To suit your needs, we offer a wide variety of options. Cola Changes in 2023What is COLA and why is it important? The cost of living adjustment, or COLA, is a social security benefit that fluctuates with inflation. It ensures that retirees can live comfortably instead of living paycheck to paycheck. The big changes in 2023. A visit to the grocery store in the last 6 months will reveal a large increase in the cost of basic groceries like bread, milk, rice, and butter. With a 6.3% inflation rate in 2022, that is the highest it has ever been in over a century. Due to this, COLA benefits are the highest they've ever been, increasing by 8.7%. To read more about COLA changes in 2023 you can read about here: If you are interested in learning more about your social security benefits, you can also contact us!

2023 Heath Insurance and Marketplace open enrollmentIt's never too early to start thinking about health insurance in 2023. Open enrollment for health insurance starts November 1st 2023 until January 15th 2023, so now is the time to talk to the Citizens Insurance Solutions team about any and all questions related to health insurance. You can get your health insurance needs met with Citizens Insurance no matter your age or location! Due to the tens of thousands of Americans of all ages she has helped with their health insurance needs, Citizens Insurance CEO Heather Majka is an elite member of the insurance business. Find the best and most affordable plan by clicking the button below.

Why Citizens Insurance Solutions believes in PickleballPickleball is a sport that is gaining popularity every day. The sport has many health benefits, such as improved cholesterol, blood pressure, and cardiovascular health. Being fit is one of the keys to living a long life, which is why Citizens Insurance Solutions sponsors this sport in their local community. In addition to providing health benefits, pickleball brings people together in our community and fosters a sense of community. It offers mental and physical benefits to individuals. To learn about Pickleplex construction Cup of HopeA Cup of Hope event took place on October 25th, which coincided with domestic violence awareness month. Salvation Army Knoxville organizes the Cup of Hope in order to raise funds for the Joy D. Baker center. Women who are victims of domestic violence can seek safety and shelter at the Joy D. Baker center in order to help start a new life. Although the event has already passed, you can still donate or find out more about this organization by visiting the Knoxville Salvation Army website.

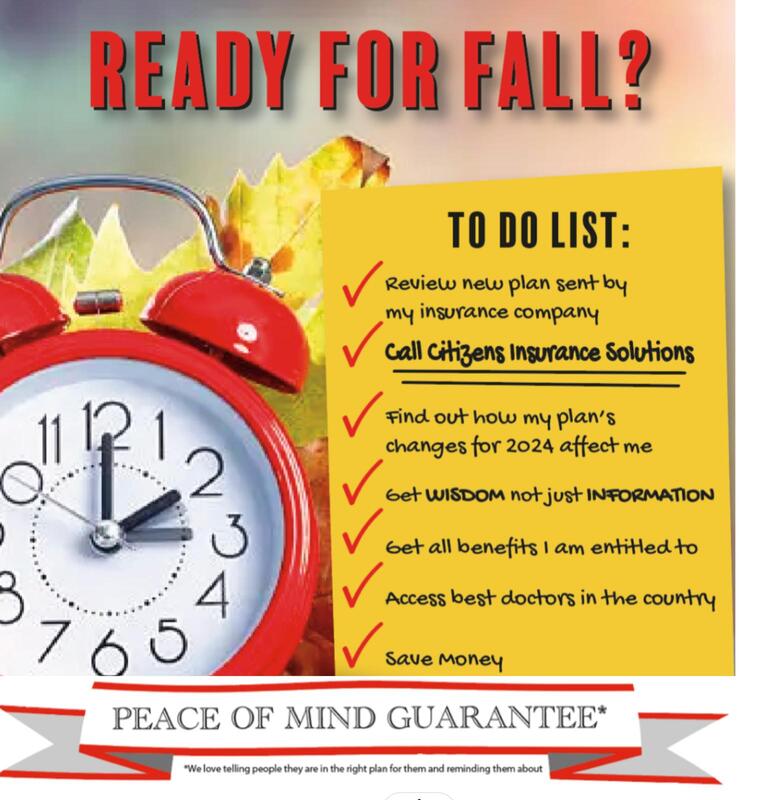

Donate to the salvation army or learn more by going to: Listen to Heather's radio show covering this topic here. See the powerpoint presentation for her 2023 Medicare changes seminar at the Public library. 2023 Changes in Medicare2023 Changes in Medicare are out and there are plenty. Here is that you need to know:

Medicare Part A & B changes include to the premium, deductibles, copays and how Medicare calculates and reimburses provides and private health plans. Let's take a closer look at Part A & B changes in Medicare for 2023.

Enrollment Timeline Changes People applying for Original Medicare during their initial enrollment period (7 month window - 3 months before their 65th birthday the month of and 3 months after your birth month) will be able to start coverage the month immediately following your signature date.. The general election period to enroll in Original Medicare which is January 1 through March 31 - now grants Medicare coverage start dates the month following the signature date whereas beneficiaries would have to wait until July 1 for Medicare to start. ESRD changes Medicare will now change how providers who care for dialysis patients are compensated. 36 months after a successful kidney transplant Medicare now offers coverage for anti rejection medicines . Medicare ends Medicare has required all insurance agents record telephone calls. Reminder - no one should call you on the phone to discuss your Medicare options unless you asked them to. Please do not deal with people who cannot answer your questions and are clearly reading a script. Please view all new plan options here More Preventative care changes:

The inflation reduction act continues to roll out improvements and changes to Medicare for 2023, 2024, and 2025. Listen to Citizens Insurance Solutions Owner on the Radio discuss 2023 Changes in Medicare10/7/2022 2022 Tellico Village Pickleball Championship & After PartyCome party with us and relax. Bring your own food and refreshments! Any ticket holder is welcome. You do not need to be a Tellico Village Resident or a pickleball player to attend.

|

This section will not be visible in live published website. Below are your current settings: Current Number Of Columns are = 2 Expand Posts Area = Gap/Space Between Posts = 12px Blog Post Style = card Use of custom card colors instead of default colors = Blog Post Card Background Color = current color Blog Post Card Shadow Color = current color Blog Post Card Border Color = current color Publish the website and visit your blog page to see the results |

|

“We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.”

|