Give Back DayCitizens Insurance Solutions contributed and volunteered to raise money for those who battle dementia and Alzheimer's. Citizens Insurance Solutions believes in supporting and giving back to the community by sponsoring events like Tellico Village Golf Association's annual "Give Back Day". All the money was raised for Our Place, which is to establish a scholarship to help those suffering from Alzheimer's and dementia who may not be able to participate in the day center. The fundraiser raised more than $6,156 for the center.

To read more click the link: https://www.tellicovillageconnection.com/news/article_59f5e578-1a44-11ed-a68c-cb57480b9198.html

0 Comments

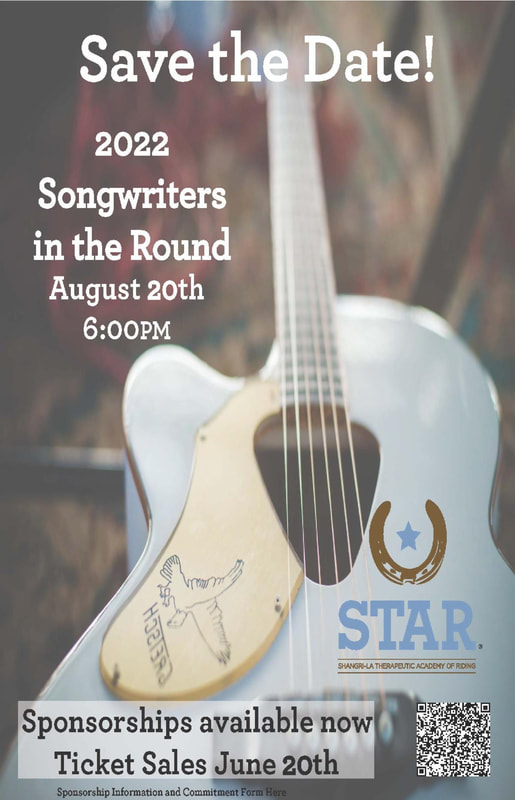

Get ready for a night you will never forget with Citizens Insurance Solutions! STAR presents Songwriters in the Round, a fun-filled night. Dinner, drinks, and live entertainment will be provided by Nashville-based artists whose songs and stories will bring the spirit of Nashville to our city.

Tickets go on sale, on June 20th! The cost is $150 per ticket this includes drinks, dinner, and live performances. All benefits will go to STAR. Learn more and buy tickets here: https://www.rideatstar.org/songwriters.html 17 Ways to Make Steady Money in RetirementToday it is easier than ever with all the resources online to make extra money to make your retirement as smooth as possible. 1. Start a blog or Online Course About Your Plan of Action in Retirement A topic or hobby that you are specialized in can be very helpful or interesting to other people. Writing blogs about it can make you money but can also keep your mind working and talking about the things you love. Some people have no idea about how to retire or need a little guidance, if you have mastered retirement people could benefit from what you have to share. Start an Online Course! 2. Rent Out a room in your houseWith everyone moving out of your home and lots of extra space, there are websites/apps like Airbnb that allow you to rent out rooms in your space. If you aren't comfortable with the idea of strangers, you can rent out to a permanent tenant. 3. Rent out your carThere are a couple rideshare apps like Turbo and Drivy that allow you to rent out your car as you please. This is a less invasive way of making money. 4. Offering pet-sitting services for friends and family.Not only will you have a furry friend temporarily, but this is also a great way to earn money. It is rewarding to do something for a friend, family, or neighbor, and whenever it is your time to go on a trip they might exchange the favor and you can save some extra money. 5. House Sit InternationallyIf you like traveling, this is for you. There are multiple sites connecting international travelers with homeowners abroad needing a pet or house-sitter. These jobs are unpaid but save you lots of money. 6. Be a Consultant for Local Businesses, Helping Them With Everything from Marketing to BookkeepingIf you have experience with marketing from your old job, local businesses near you could use your help. If you don't have experience with marketing, then bookkeeping could be for you. 7. Start a YouTube ChannelYoutube is a site for anyone and everyone. People go on youtube to figure out how to do the most basic to more difficult tasks. Share your knowledge on different tasks by creating youtube videos. Popular channels on youtube can lead to a steady income through ad revenue and sponsorships. 8. Tutor StudentsWith tutoring, you can do it in person or online from the comforts of your own home. You can choose your own rates from $20 an hour, even higher if you have teaching experience. Children from really young to adults in grad school need tutors so there will always be a need for this job. 9. Grade Standardized TestGrading ACT, college board, and the nationwide standardized tests are straightforward and you are able to choose when you want to work. 10. Do odd jobs for people in your neighborhoodMaybe you want something more outdoors and more active. There are a lot of jobs just in your neighborhood that people don't want to do or don't have time for. Things like mowing the lawn, raking leaves, and shoveling driveways. 11. Babysit for Families and FriendsBeing older and having experience with children and grandchildren you will be seen as more trustworthy to parents. Some parents need date nights or just nights out. Babysitting is a way to earn good money starting from $15 an hour and your friends and family will thank you. 12. Sell Handmade Crafts OnlineHandmade things online can make a fortune. Whether it's pottery, knitting, or paintings. If you don't have any idea how to do any of them, you can find easy-to-follow how-to videos on Youtube. There are websites/apps out there that allow you to post your things online, like Etsy. 13. Try Selling Your Wares at the Flea MarketIf you want the more traditional way of selling your homemade things, then you can sign up for a booth at a local flea market. 14. Dog WalkThis is another fun job if you like being active and you love dogs. Apps like Wags and Rover make it easy and convenient to start your journey of being a dog walker. 15. Become a Study ParticipantThese jobs range anywhere from $50-300 a day. There are many different studies you can be a part of and how long you want to do the study for, you can pick and choose as you please. 16. Donate PlasmaDonating plasma is helping thousands of people around the world. You can make up to $75 per appointment donating plasma. 17. Writing ResumesHaving any job in the past can help you with having experience in this job. You can earn around $65 per resume. Depending on your past work experience you may or may not need a certificate in order to write resumes.

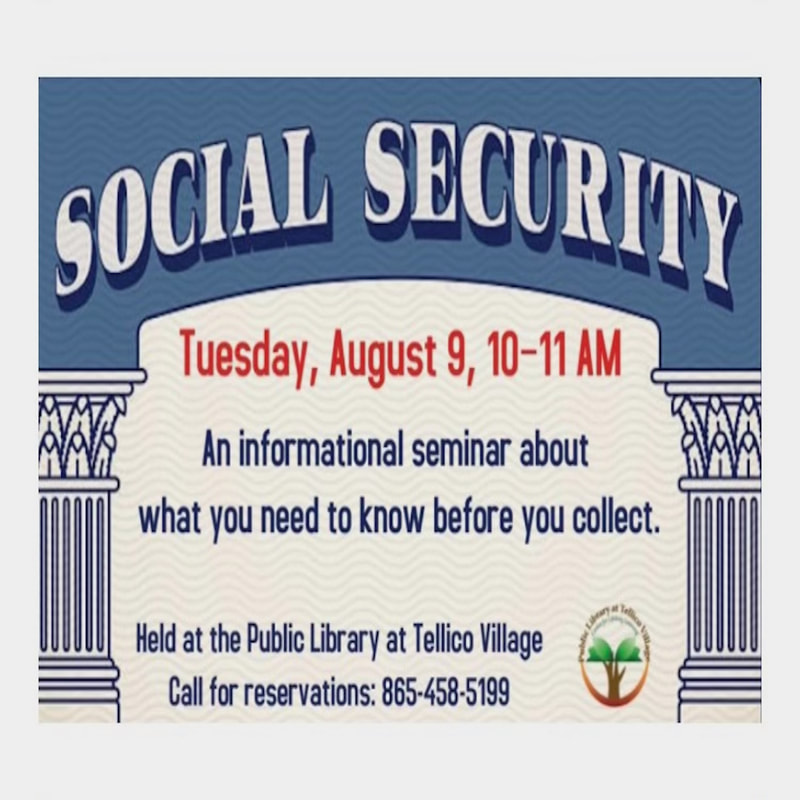

Social Security Class offered at the Tellico Village Public LibraryThe Social Security class we will offer will help you understand the ins and outs before you begin collecting. We invite you to join us for a special presentation at the Tellico Village Public Library. You will learn: – How to decide when to collect your benefits. – How to coordinate benefits with your spouse. – The Social Security options available to divorcees. – How the death of a spouse affects your Social Security benefits. – How work affects your benefits. – How your benefits are taxed and what you can do about it. Call The Library to Register: 865-485-5199

Event Location: Tellico Village Public Library 300 Irene Lane Loudon, Tennessee 37774 Inflation Causes a Delay in Retirement for AmericansWith inflation and the rise of consumer costs, Americans of any age are impacted monetarily. 36% of Americans needed to diminish their savings and 21% needed to lessen their retirement savings. Because of the need to lessen, their retirement will be postponed. How Americans are Offsetting Increased Cost of Living80% of Americans were surveyed plan how they planned to counterbalance expansion to the expense of ordinary things.

Best practices to assist Americans with overseeing through the inflationary periodsThe most ideal way to oversee finance is to make a month to month and yearly spending plans, have. the composed monetary arrangement, and meet with a financial guide month to month. Tips to keep up with the rising rates of inflation

AuthorThis post was written by BMO Harris Bank. The Pandemic and Its Impact on the Mental Health of Older AdultsFor almost two years of visiting family in person, hugs and smiles were all practically none existent during COVID-19. Older adults had greater worries and more isolation, especially if institutionalized. Depression and anxiety in older adults doubled due to isolation and worry among Medicare beneficiaries. What mental health benefits and substance use disorder benefits does Medicare cover? Medicare covers a range of mental health and substance use disorder services, both inpatient and outpatient, and covers outpatient prescription drugs used to treat these conditions Medicare Advantage plans are required to cover benefits covered under traditional Medicare and most cover Part D prescription drugs as well, but out-of-pocket costs may differ between traditional Medicare and Medicare Advantage plans, and vary from one Medicare Advantage plan to another. Inpatient Services • Medicare Part A covers inpatient care for beneficiaries who need mental health treatment in either a general hospital or a psychiatric hospital. • Medicare Part B covers one depression screening per year, a one-time “welcome to Medicare” visit, which includes a review of risk factors for depression, and an annual “wellness” visit, where beneficiaries can discuss their mental health status. Part B also covers individual and group psychotherapy with doctors (or with certain other licensed professionals, depending on state rules), family counseling (if the main purpose is to help with treatment), psychiatric evaluation, medication management, and partial hospitalization. • Part B also covers outpatient services related to substance use disorders including opioid use disorder treatment services, which include medication, counseling, drug testing, and individual and group therapy. Medicare covers one alcohol misuse screening per year, and for beneficiaries determined to be misusing alcohol, four counseling sessions per year. Medicare also covers up to 8 tobacco cessation counseling sessions in a 12-month period. Prescription Drugs The Medicare Part D program provides an outpatient prescription drug benefit to people on Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) or Medicare Advantage prescription drug plans (MA-PDs). Medicare Part D prescription drug plans cover retail prescription drugs related to mental health and are required to cover all or substantially all antidepressants, antipsychotics, and anticonvulsants (such as benzodiazepines), as each is one of the six protected classes of drugs in Part D. Which health providers can bill Medicare directly for mental health and substance use disorder services, and how much does Medicare pay for these services? Medicare provides coverage and reimbursement for mental health services provided by psychiatrists or other doctors, clinical psychologists, clinical social workers, clinical nurse specialists, nurse practitioners, and physician assistants. Medicare does not provide coverage or reimbursement for mental health services provided by licensed professional counselors and licensed marriage and family therapists. Medicare fees vary by type of provider, according to the Medicare Physician Fee Schedule: Medicare Provider Reimbursement for Mental Health and Substance Use Disorder Services ✓ Provider Type ✓ Provider Payment Rate ✓ Psychiatrist Paid at 100% under Medicare Physician Fee Schedule ✓ Clinical Psychologist Paid at 100% under Medicare Physician Fee Schedule* ✓ Clinical Social Worker Paid at 75% of the clinical psychologist’s Medicare Physician Fee Schedule* ✓ Clinical Nurse Specialist Paid at 80% of the lesser of the actual charge or 85% of the amount a physician gets under the Medicare Physician Fee Schedule* ✓ Nurse Practitioner Paid at 80% of the lesser of the actual charge or 85% of the amount a physician gets under the Medicare Physician Fee Schedule* ✓ Physician Assistant Paid at 80% of the lesser of the actual charge or 85% of the amount a physician gets under the Medicare Physician Fee Schedule* NOTE: *Paid only on assignment. SOURCE: Centers for Medicare & Medicaid Services, Medicare Mental Health, March 2022. PNG Are psychiatrists accessible to Medicare beneficiaries? The majority of physicians, both primary care and specialists, report taking new Medicare patients, similar to the share who take new privately insured patients. Psychiatrists, however, are less likely than other specialists to take new Medicare (or private insurance) patients. According to a recent KFF analysis, 60% of psychiatrists are accepting new Medicare patients, which is just over 20 percentage points lower than the share of physicians in general/family practice accepting new patients (81%). However, the survey used to conduct the analysis does not distinguish among physicians seeing new patients covered under traditional Medicare or Medicare Advantage, so it is not clear whether physicians are more inclined to accept new Medicare patients in either Medicare Advantage plans or traditional Medicare. Further, psychiatrists are more likely than other specialists to “opt out” of Medicare altogether. Providers who opt out of Medicare do not participate in the Medicare program and instead enter into private contracts with their Medicare patients, allowing them to bill their Medicare patients any amount they determine is appropriate. Overall, 1% of all non-pediatric physicians have formally opted-out of the Medicare program, with opt-out rates highest among psychiatrists: 7.5% of psychiatrists opted out in 2022. In fact, psychiatrists account for 42% of the 10,105 physicians opting out of Medicare in 2022. This is why we offer services like A Free insurance review, exercise classes, and volunteer for programs that call or sit with shut-ins, deliver meals, mail cards, gifts, and more! Contact us today to see how we can help you and/or your family anywhere in the USA! Best Things to Do in Knoxville with GrandchildrenIs it your week to spend much-needed quality time with your grandchildren? There are so many wonderful things to do with them in the fantastic city of Knoxville, Tennessee. Founded in 1791, Knoxville is the third-largest city in Tennessee and is home to exciting museums, beautiful parks, and endless entertainment opportunities. If you're ready to have some fun, here is our list of the best things to do with grandchildren in Knoxville! 1. Zoo Knoxville in East Knoxville What better way to get outside than to see and learn about animals? Zoo Knoxville is open from 9:00 a.m. to 5:00 p.m. daily and closes only on Thanksgiving, Christmas Eve, and Christmas Day. Parking is only 5 dollars. The zoo is the birthplace of the first African elephant born in the Western Hemisphere - the adorable Little Diamond. An Aldabra Giant Tortoise named Big Al also lives at the zoo. He weighs an impressive 525 pounds and is estimated to be about 150 yearsold! Other fun animals at Zoo Knoxville include:

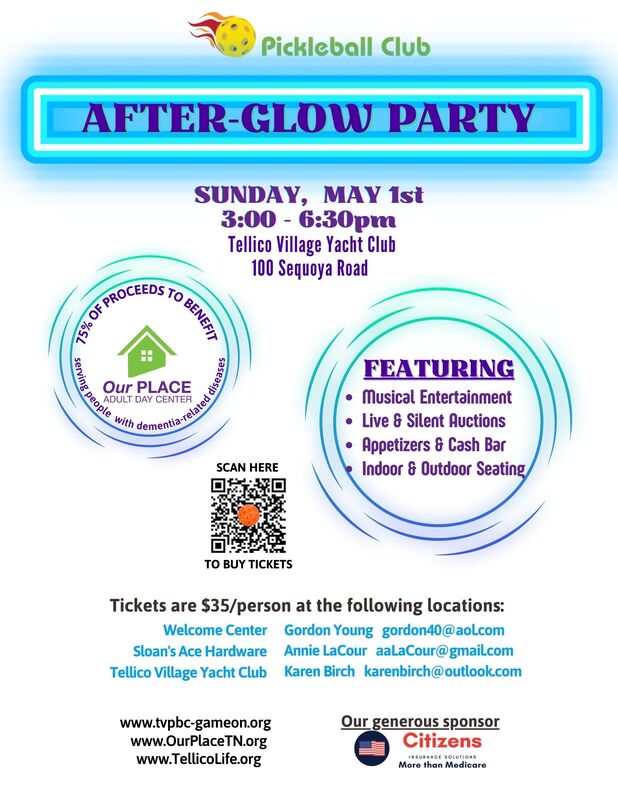

2. South Knoxville's Ijams Nature Center For kids five and up, try the exciting and adventure-packed Ijams Nature Center located on 315 acres of protected land in south Knoxville. This nonprofit environmental education center is full of so many exciting things to do! You can explore the outdoors and enjoy their playground, including stone, wood, and boulder fields. Each section provides a different way to exercise, and you can even download workouts in their green workout space or take the Primal Playground Challenge! You can climb, hike, bike, paddleboard, and swim at the Ijams Nature Center. The canoes, kayaks, and paddleboards rent for $14 per hour. Here, the adventures are endless for your little ones! 3. Downtown Knoxville's Market Square After enjoying some quality time with your grandkids in nature, head to the city and check out the vibrant and bustling Market Square in Downtown Knoxville. First used in the mid-1800s, this famous square was originally for regional farmers. It is a unique and fun-filled area with plenty of shopping, dining, and entertainment options - exciting for all ages! You can take the kids to see a movie, outdoor concert, or even Shakespeare on the Square. When you're done, you can head over to play in the water fountains near Krutch Park or visit Knoxville’s Urban Wilderness, a nearby 1,000-acre stretch of land which features over 50 miles of trails. 4. Knoxville Museum of Art Are your grandkids budding artists? Inspire them with a trip to the Knoxville Museum of Art! It's appropriate for ages three and up, and admission is free. You can enjoy a stroll through their beautiful galleries and elegant exhibitions or have a picnic in their beautiful outdoor space. The museum is open daily Tuesday through Saturday from 10 a.m. to 5 p.m. and Sunday from 1 p.m. to 5 p.m. Be sure to check your calendar before going for exciting events, informational workshops, and educational lectures. 5. World's Fair Park One of the go-to experiences when visiting Knoxville is the World's Fair Park, located in the heart of the city. This vast cultural space features a beautiful riverfront park and kid-friendly splash pads and fountains. The grandkids can play in the fountains from mid-April to early October. There are two remaining structures left from the 1982 World’s Fair - an amphitheater and the newly renovated Sunsphere. The Sunsphere is a tower with an observation deck that offers 360-degree views of the original 1982 World’s Fair site. The fee is $5, and you need a reservation. 6. Seven Islands State Birding Park Another must-see is the wildlife refuge, Seven Islands State Birding Park. What better way for the grandkids to spread their wings than birdwatching! This extensive 425-acre haven in East Knoxville features lush, beautiful meadows and gardens, including a captivating sunflower garden. Seven Islands boasts over eight miles of natural trails and includes impressive views of the Smoky Mountains. The park is home to over 190 species of birds, including songbirds, waterfowl, and hawks. There are even some old barns that house Barn Owls! 7. Muse Knoxville Are the grandchildren toddlers? The Muse in East Knoxville is an excellent place for young ones. This creative museum offers fascinating exhibits, exciting facilities, and a variety of activities for kids. There's a book nook, planetarium, illumination station, and outdoor spaces. The kids will love racing air rockets and interacting with the STEAM stations. Kids 8 and up can enjoy hands-on physical science stations in the museum's exhibit space. This museum brings science to life for young kids, showing them how it connects to their everyday world and environment. Admission is $10 per person, and seniors 65+ only pay $5. Parking is free. Article written by Amara Home Care in Chattanooga Tennessee Afterglow Party and Fundraiser at the Tellico Village Yacht Club for Our PlaceJoin Citizens Insurance and the Tellico Village community in Loudon as our guests to raise money for Our Place!

Our Place's Mission is to improve quality of life by providing a day program of care, social interaction, and therapeutic activities in a safe and nurturing environment to senior adults living with Alzheimer's or other dementia-related diseases. Our PLACE works to support caregivers and care partners through respite, support, education, and resources. Tickets are $35 and are tax-deductible. Citizens Insurance Solutions is a proud supporter of local community resources, veterans, senior programs, and more! Even if you do not want to drink, dance, eat, and bid on silent auction items, you can still make a donation or purchase a tax-deductible ticket and/or invite your friends! Tips to Stay Active in Your Golden YearsAs we trudge through the workday, laden with responsibilities, never-ending to-do lists, overbooked schedules, and countless commitments, we can’t help but let our minds drift to the blissful days of retirement. We all have a vision of what life will look like once this day arrives. Dreams of endless free time, relaxation, carefree travel, and a week full of Saturdays are just a few of the things that come to mind. But in reality, retirement isn’t always the cakewalk we envisioned it to be! As we settle into a routine, we can easily become complacent with the day-to-day monotony. If we aren’t intentional with our time and decisions, we can inadvertently lead ourselves down the road of poor physical and mental health.

We must strive to be engaged mentally, physically, socially, spiritually, and even romantically for our Golden Years to truly sparkle and shine! Though this alone may sound like a full-time job (been there… done that), it can be quite simple. If we deliberate with our actions and choices, we can ensure that our years beyond retirement are thoroughly enjoyed and embraced. MENTALLY It all begins with our attitude– after all, “they” say your attitude determines your altitude, and it’s no different when it comes to your retirement years. Taking control of your mental health and approaching the day with a “glass half full” perspective is proven to affect your overall health positively. A positive outlook allows you to better cope with negative situations; it’s the driving force behind our decisions that helps steer us in the right direction. An optimistic mindset leads to an overall healthier lifestyle, improved physical health, and increased happiness, self-confidence, and success. PHYSICALLY The two main components of physical health include a balanced diet and regular exercise. Maintaining a healthy weight is crucial for optimal health and sets the stage for our overall wellbeing. When you’re overweight, you’re at a greater risk for heart disease, elevated blood pressure, diabetes, high cholesterol, stroke, and other severe health conditions. You can achieve and maintain a healthy weight by consuming a balanced diet filled with lean proteins, fruits and vegetables, and complex carbohydrates. Additionally, it’s best to eat 4-5 small meals per day to help maintain blood sugar levels, allowing you to feel more energetic. Incorporating daily activity into your schedule is equally as important as your nutrition. Organized exercise classes such as water aerobics, yoga, Jazzercise, and circuit training are great opportunities to be active regularly. If you have access to a gym that offers these. This was written by our guest writer at the Senior Directory! A reputable community resource and nationwide publication. Read our Article as featured in the Senior DirectoryOur very own owner, Heather Majka - has written an article to compare and contrast the two in a well known and trusted senior publication and resource, the Senior Directory.

|

This section will not be visible in live published website. Below are your current settings: Current Number Of Columns are = 2 Expand Posts Area = Gap/Space Between Posts = 12px Blog Post Style = card Use of custom card colors instead of default colors = Blog Post Card Background Color = current color Blog Post Card Shadow Color = current color Blog Post Card Border Color = current color Publish the website and visit your blog page to see the results |

|

“We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.”

|